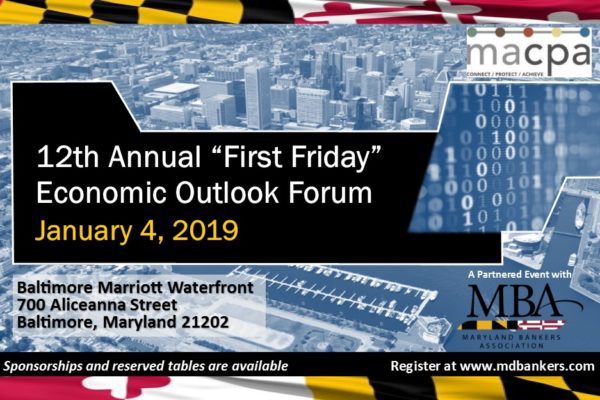

First, full disclosure. I am not a CPA or an economist, but I did attend (as I always do) the Maryland Bankers Association First Friday Economic Outlook Forum.

First, full disclosure. I am not a CPA or an economist, but I did attend (as I always do) the Maryland Bankers Association First Friday Economic Outlook Forum.

It is an amazing event and great way to start the new year, with perspectives from the best and brightest. Maryland’s own and awesome Anirban Basu is always there to offer his insights into the year past and what the year ahead might hold, with his funny color commentary that keeps it light and keeps me engaged. Then Basu moderates a panel of really smart economist experts to add more, challenge each other, and answer questions from a room of 600-plus bankers.

In past years the panel would sometimes agree, but more often they’d offer contrary opinions with references and intellect that were way over my non-CPA, non-economist head. I’d turn to our CFO and CPA, Skip Falatko, and say, “What?” Then on the ride home, he’d bring it down to a level that I would (kind of) understand.

Not today.

Today there was clear agreement, over and over again, that the sky is not falling. And it made sense, to even me. Here’s a summary of the highlights, thanks to my friend, Skip Falatko:

- The U.S. economy is strong and there are no major signs of a recession looming. We’re not seeing any areas of over-investment (i.e. bubbles) that would presage a downturn.

- If an economist went to sleep 10 years ago and woke up today, they would be delighted with where we stand. Employment is strong, inflation is in check, GDP is solid, and the equity market, despite recent turmoil, stands at a high valuation.

- U.S. consumer spending, which makes up 70 percent of GDP, shows no sign of slowing down.

- Continued GDP growth needs some combination of population growth and increased productivity. So, 2019 is expected to be a solid year but likely won’t match 2018’s results (pending the 4Q 2018 GDP number release on Jan. 31).

- The Baltic Dry Index, a measure of the cost of transporting unfinished bulk goods such as iron ore, cement, coal, etc., and Anirban Basu’s favorite quick indicator of the global economy, has been trending up (positive) over the past three years. Interestingly, as an aside, the Baltic Dry Index is issued by the Baltic Exchange which traces it origins back to the Virginia and Maryland Coffee House (later the Virginia and Baltick Coffee House) circa 1744 on Threadneedle Street in London where merchants met to discuss trade.

- The amped up political environment is a bit of a sideshow to the economy. It is a blessing that that seems to be our main worry.

- The equity market earnings currently justify the historically high market valuations, despite recent turmoil in the market.

- The panelists were generally in agreement with the Fed’s interest rate moves to date and foresee either no rate increase or maybe one rate increase in 2019.

- China’s per capita GDP is 10 percent of the United States’. We should be working to improve worldwide living standards as raising worldwide GDP is in our best interests.

- Given all that, if you’re looking for factors to be concerned about, be worried about the U.S. budget deficit / debt, China’s economy, trade wars not being resolved, and student debt.

So, take my non-CPA, non-economist word for it: Based on what I heard from Basu and these other really smart economists — Luke Tilley of Wilmington Trust, James Glassman of Chase Commercial Banking, and Mark McGlone of PNC Asset Management Group — we’re going to be OK. At least for now. Happy 2019!